Blogs

Trading Terminologies & Abbreviations with Examples

Let’s learn some important forex trading terminologies and abbreviations. We will always update this page. So you can bookmark it for the next visits.

BOS (Break of structure)

When price breaks a low or high then it is called BOS or break of structure.

dBOS (Double break of structure)

When price breaks two lows or highs respectively then it is called dBOS or double break of structure.

mBOS (Minor break of structure)

When price breaks lows or highs in the lower timeframes then it is called mBOS or minor break of structure.

OB (Order block)

OB or order block is the last opposing one or multiple close candles before a strong directional move. The last sell Candle before the bullish impulse move is called bullish order block and the last buy candle before the bearish impulse move is called bearish order block.

AOI (Area of interest)

These are the areas where we expect the price will react and has the possibility to reverse direction.

POI (Point of interest)

It is also called DP or decision point.

IMB (Imbalance)

Imbalance is an area of unequal market moves where there are only buyers or only sellers exist in the market. It is inefficient or unhealthy price action. It shows disequilibrium between Buyers/Sellers. So an imbalance means unfair price action where the market will almost always come back to fill. Here, the wicks do not fill each other (If they do then it is healthy price action and not an imbalance). It is not mitigation. So, the price doesn’t have to reverse from that point).

imbalance in forex trading chart

EQ (Equilibrium)

It means fair market value or 50%.

INF (Inefficiency)

It indicates the lack of buyers or sellers in price action, leaving disequilibrium that eventually needs to be filled. If there’s a gap with a large candle that’s the inefficiency of price.

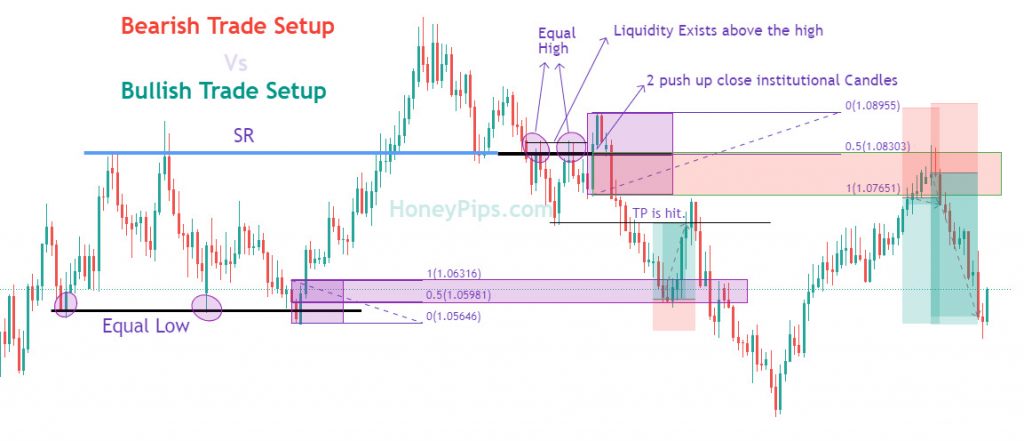

LQ (Liquidity)

Liquidity simply means money or huge opposite orders to be filled to fuel the movement of the market institutions.

IPA (Inefficient price action)

Inefficient price action or imbalance(Lack of Buyers/Sellers in price action, leaving disequilibrium that eventually needs to be filled)

EQL (Equal lows)

It simply means the liquidity below the double bottom (DB).

EQH (Equal highs)

It means the liquidity above the double top (DT).

IT (Institutional Trading)

There are several ways to identify institutional trading. These are:

SHC (Stop Hunt Candle)

Fake-out

OB (Order Block)

Large Volume Range

Imbalances (Lack of Buyers/Sellers in price action, leaving disequilibrium that eventually needs to be filled)

WKF (Wyckoff)

WAS – Wyckoff Accumulation Schematic

WDS – Wyckoff Distribution Schematic

ST – Secondary Test

SOS – Sign of Strength

SOW – Sign of Weakness

LPS – Last Point of Support

LPSY – Last Point of Supply

UT – Upthrust

UTAD – Upthrust After Distribution

SC – Selling Climax

BC – Buying Climax

AR – Automatic Rally Reaction)

TR – Trading Range

PS – Preliminary Support

PSY – Preliminary Supply

Other Abbreviations

BFI – Banks & Financial Institutions

PA – Price action

HH – Higher High

HL – Higher Low

LH – Lower High

LL – Lower Low

Fib – Fibonacci

TF – TF

LTF – Lower time frames

HTF – Higher time frames

MN – Monthly

W – Weekly

D – Daily

H4 – 4 hours

H1 – 1 hour

M15 – 15 minutes

M1 – 1 minute

MS – Market Structure

MOM – Momentum

HTF – Higher Time Frame

LTF – Lower Time Frame

R = Reward/percentage

RSP – Real Structure Point

PRZ – Price Reversal Zone

CPB – Complex Pullback

M – Momentum

RR – Risk: Reward

TGT – Target

SL – Stop Loss

BE – Breakeven

BSL – Buy-side liquidity

SSL – Sell-side liquidity

SC – Sponsored candle

IFC – Institutionally funded candle

EOF – Expectational order flow

Liq – Liquidity

SMC – Smart Money Concepts

SB – Sub break of structure

DD – Drawdown

Be – Bearish

Bu – Bullish

HNS – Head and Shoulders

IT – Institutional Traders

CO – Composite Operators

WHB – Weak Handed Buyers

WHS – Weak Handed Sellers

SHC – Stop Hunt Candle

OBIM – Order Block with Imbalance

OBOB – Lower timeframe Order Block within a higher timeframe Order Block

TR – Trading Range

IT – Institutional Traders

CO – Composite Operators

LP – Liquidity Providers