The #1 online platform helping traders worldwide

If you are a trader or complete beginner looking to make the most of your investments then you came to the right place! Market Masters can help you with that! Our educational resources are designed for traders of all skill levels and provide key strategies to help you in the financial markets. With our tools, you can start trading smarter and make sound decisions backed by reliable data. Get started now and take your investing to the next level with Market Masters!

What is Forex?

MEET THE FOUNDER

Ricky Andrade is the visionary founder of Market Masters, a dynamic force in the world of Forex trading. With over 8 years of hands-on experience in the forex market, Ricky has honed his trading skills to perfection. He has not only mastered the intricate art of currency trading but has also made it his mission to empower fellow traders on their journey to financial success.

Ricky's journey began as a passionate forex enthusiast who was eager to unlock the secrets of the financial markets. Through years of dedication, research, and countless hours of trading, he transformed himself into a true market master. Recognizing the need for a guiding light in the often complex and volatile world of forex, Ricky founded Market Masters.

Under his expert guidance, Market Masters has become a beacon for traders seeking knowledge, strategies, and support to navigate the forex landscape successfully. Ricky's commitment to education and his genuine desire to help traders realize their potential have turned Market Masters into a community of like-minded individuals striving for financial freedom.

Ricky Andrade's experience, expertise, and dedication make him the driving force behind Market Masters, and he continues to lead the way, sharing his wisdom with traders, both seasoned and aspiring, to help them achieve their financial goals. With Ricky at the helm, Market Masters is not just a company but a movement, shaping the future of forex trading.

As Seen On

Our Algorithms

All-Access

$10,000 one-time

Pay one price to gain access to all our current and future trading softwares.

Our Services

EXPERIENCE BEST YOUR COMPANY PROPERTIES

View Featured Projects

Furnished Villas

Your company SmartHome

Your Company Resort

Home Apartments

Enjoyable Amenities

Boluptate velit cillum dolore fugiat nulla pariatur. Excepteur anim idet laborum. Sed ut perspiciatis und omnis iste natus sit holuptatem accusantium sed laudantium.

Dryer & Washer

En-Suite Bathroom

King Size Beds

Package Services

Sports & Golf Hall

Grand Library

INTEGRATED REAL ESTATE GROUP

Powered By Builders Loved By People

INTEGRATED REAL ESTATE GROUP

Industry Leader In Property Development

Constructing Since 1995, For Lasting & Positive Relations

Koluptate velit cillum dolre fugiat nula pariatur. Excepteur anim idet laborum. Sed ut perspiciatis und omnis iste natus goluptatem acusantium dolore mque lorem ipsum dolor sit amet consectetur adipisicing elit sed incididunt.

Floor Planning

Architecture Design

Landscape Design

Frequently Asked Questions

Who is Market Masters for?

Market Masters is designed for ambitious individuals of all experience levels from complete beginners to seasoned traders, the services have been designed to be beautifully simple whilst delivering the highest value of knowledge the market has to offer. Don’t worry about the ins and outs, we will take care of you!

Who is Market Masters NOT for?

It isn’t designed for folks that are looking to get-rich-quick, haven’t considered their finances going forward, have a negative attitude or don’t want to put in the work… Simple as that.

What if I have zero experience?

Well, you’re in the right hands! All of Market Masters education is stripped down to its most simple form to allow novice traders to understand every facet of the course whilst keeping it in-depth to hold the attention of more experienced individuals. No matter if you are a complete beginner or an experienced trader with 3 years in the field, you will find value in my services.

When can I start studying ?

You may enroll any day of the year. Be online and start studying within a matter of seconds after enrolling.

Trading Terminologies & Abbreviations with Examples

Let’s learn some important forex trading terminologies and abbreviations. We will always update this page. So you can bookmark it for the next visits.

BOS (Break of structure)

When price breaks a low or high then it is called BOS or break of structure.

dBOS (Double break of structure)

When price breaks two lows or highs respectively then it is called dBOS or double break of structure.

mBOS (Minor break of structure)

When price breaks lows or highs in the lower timeframes then it is called mBOS or minor break of structure.

OB (Order block)

OB or order block is the last opposing one or multiple close candles before a strong directional move. The last sell Candle before the bullish impulse move is called bullish order block and the last buy candle before the bearish impulse move is called bearish order block.

AOI (Area of interest)

These are the areas where we expect the price will react and has the possibility to reverse direction.

POI (Point of interest)

It is also called DP or decision point.

IMB (Imbalance)

Imbalance is an area of unequal market moves where there are only buyers or only sellers exist in the market. It is inefficient or unhealthy price action. It shows disequilibrium between Buyers/Sellers. So an imbalance means unfair price action where the market will almost always come back to fill. Here, the wicks do not fill each other (If they do then it is healthy price action and not an imbalance). It is not mitigation. So, the price doesn’t have to reverse from that point).

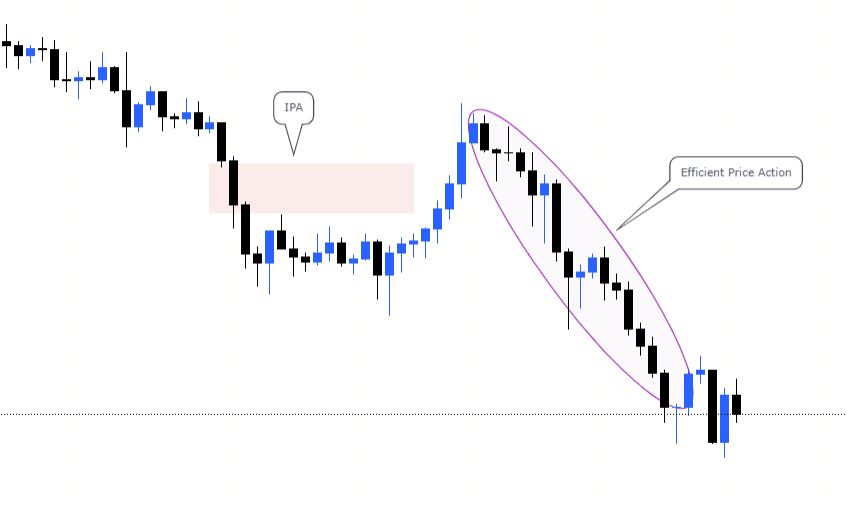

imbalance in forex trading chart

EQ (Equilibrium)

It means fair market value or 50%.

INF (Inefficiency)

It indicates the lack of buyers or sellers in price action, leaving disequilibrium that eventually needs to be filled. If there’s a gap with a large candle that’s the inefficiency of price.

LQ (Liquidity)

Liquidity simply means money or huge opposite orders to be filled to fuel the movement of the market institutions.

IPA (Inefficient price action)

Inefficient price action or imbalance(Lack of Buyers/Sellers in price action, leaving disequilibrium that eventually needs to be filled)

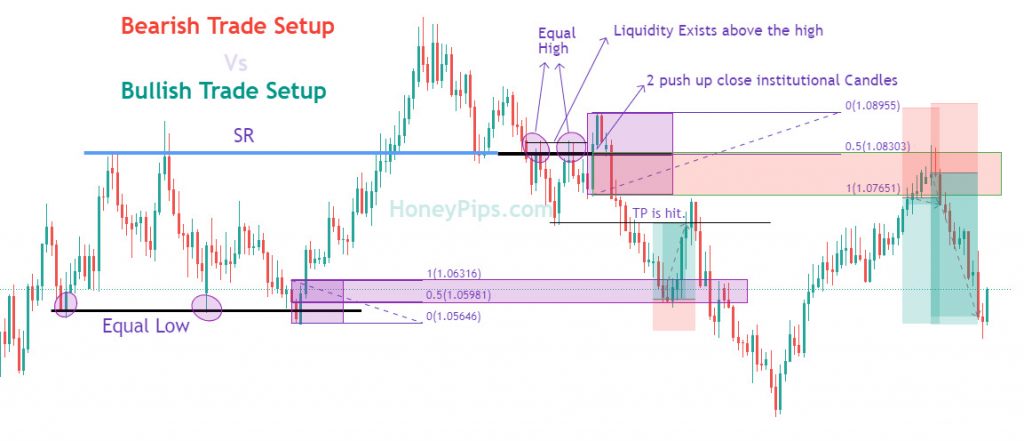

EQL (Equal lows)

It simply means the liquidity below the double bottom (DB).

EQH (Equal highs)

It means the liquidity above the double top (DT).

IT (Institutional Trading)

There are several ways to identify institutional trading. These are:

SHC (Stop Hunt Candle)

Fake-out

OB (Order Block)

Large Volume Range

Imbalances (Lack of Buyers/Sellers in price action, leaving disequilibrium that eventually needs to be filled)

WKF (Wyckoff)

WAS – Wyckoff Accumulation Schematic

WDS – Wyckoff Distribution Schematic

ST – Secondary Test

SOS – Sign of Strength

SOW – Sign of Weakness

LPS – Last Point of Support

LPSY – Last Point of Supply

UT – Upthrust

UTAD – Upthrust After Distribution

SC – Selling Climax

BC – Buying Climax

AR – Automatic Rally Reaction)

TR – Trading Range

PS – Preliminary Support

PSY – Preliminary Supply

Other Abbreviations

BFI – Banks & Financial Institutions

PA – Price action

HH – Higher High

HL – Higher Low

LH – Lower High

LL – Lower Low

Fib – Fibonacci

TF – TF

LTF – Lower time frames

HTF – Higher time frames

MN – Monthly

W – Weekly

D – Daily

H4 – 4 hours

H1 – 1 hour

M15 – 15 minutes

M1 – 1 minute

MS – Market Structure

MOM – Momentum

HTF – Higher Time Frame

LTF – Lower Time Frame

R = Reward/percentage

RSP – Real Structure Point

PRZ – Price Reversal Zone

CPB – Complex Pullback

M – Momentum

RR – Risk: Reward

TGT – Target

SL – Stop Loss

BE – Breakeven

BSL – Buy-side liquidity

SSL – Sell-side liquidity

SC – Sponsored candle

IFC – Institutionally funded candle

EOF – Expectational order flow

Liq – Liquidity

SMC – Smart Money Concepts

SB – Sub break of structure

DD – Drawdown

Be – Bearish

Bu – Bullish

HNS – Head and Shoulders

IT – Institutional Traders

CO – Composite Operators

WHB – Weak Handed Buyers

WHS – Weak Handed Sellers

SHC – Stop Hunt Candle

OBIM – Order Block with Imbalance

OBOB – Lower timeframe Order Block within a higher timeframe Order Block

TR – Trading Range

IT – Institutional Traders

CO – Composite Operators

LP – Liquidity Providers